- Personal

- AccountsHow can we help you?ToolsMy Online Bank 24/7

- Access your accounts

- Deposit and withdraw

- Pay your bills

- Transfer funds from your accounts

- Credit Cards & LoansHow can we help you?ToolsApply for a personal loan to consolidate your debt

- From $2,000 up to $75,000

- 12 to 84 months’ terms

Benefits for credit card customersLearn more - Insurance & InvestmentsNeed insurance?Plan for the futureQuote an Insurance

Contact one of our representatives.

Insurance ClaimsBegin your claim here, call 787.706.4111 (dial 1 for Customer Service) or visit our offices on workdays, Monday through Friday from 8:00 a.m. to 5:00 p.m.

- ServicesTargeted SegmentsMore ServicesMy Online Bank 24/7

- Access your accounts

- Deposit and withdraw

- Pay your bills

- Transfer funds from your accounts

Turns and Appointments in branchesLearn more

- Accounts

- Business

- Popular One

- About us

How can we help you?

Our Overdraft Service1 may cover transactions made in our ATMs and your everyday debit card transactions even if you don't have sufficient funds in your account.

What are the advantages for you?

This service makes possible that your transactions in ATMs and everyday debit card transactions be processed even when you have insufficient funds in your account, so your transactions will not be declined. However, this does not guarantee that your overdrafts will always be processed to cover these transactions.

What are the costs?

The Bank will charge you a fee of $15 for each transaction paid against Insufficient or Unavailable Funds, when said transaction is greater than $5. The Bank will charge daily up to a maximum of 5 overdraft fees for these transactions, excluding Saturday, Sunday and Federal Holidays.

We also offer overdraft protection plans, such as Reserve Lines of Credit which, may be less expensive than our standard overdraft practices. To learn more, ask us about these plans.

What should you do if you want Banco Popular to authorize and pay transactions at ATMs and everyday debit card transactions:

To authorize or enroll, you must complete a Consent for Overdraft Service.

- You can do this by logging in to Mi Banco Mobile. On the menu, select “Go to Desktop Version”, under “Accounts” select “Account Services”, choose the accounts you want to consent, and press submit.

- You can also download the consent form and deliver it to the nearest branch, or mail the form to Banco Popular, Customer Management Support (649), PO Box 362708, San Juan, PR 00936-2708.

If you don't have a copy of Acrobat Reader, click here to obtain a free copy.

If you have more than one deposit account, you must complete a form for each account in which you want the service.

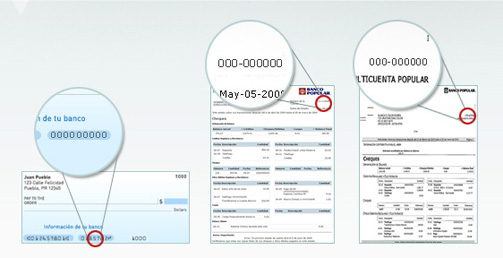

You can find your account number in your checks or in your account statement sent via postal service or online (e-Statement).

Service offered by Banco Popular de Puerto Rico.

1

The Overdraft Service doesn’t apply to the following accounts: ATH POP, CADI, Club del Ahorro, Pronto Popular, U-Save, Acceso Universitario and Cuenta Popular.

Puerto Rico

Puerto Rico