- Personal

- AccountsHow can we help you?ToolsMy Online Bank 24/7

- Access your accounts

- Deposit and withdraw

- Pay your bills

- Transfer funds from your accounts

- Credit Cards & LoansHow can we help you?ToolsApply for a personal loan to consolidate your debt

- From $2,000 up to $75,000

- 12 to 84 months’ terms

Benefits for credit card customersLearn more - Insurance & InvestmentsNeed insurance?Plan for the futureQuote an Insurance

Contact one of our representatives.

Insurance ClaimsBegin your claim here, call 787.706.4111 (dial 1 for Customer Service) or visit our offices on workdays, Monday through Friday from 8:00 a.m. to 5:00 p.m.

- ServicesTargeted SegmentsMore ServicesMy Online Bank 24/7

- Access your accounts

- Deposit and withdraw

- Pay your bills

- Transfer funds from your accounts

Turns and Appointments in branchesLearn more

- Accounts

- Business

- Popular One

- About us

How can we help you?

Money Management Tool

Once you have learned to use Mi Banco Online tool you will be able to take control of your expenses and your budget, identify expenses, make adjustments and save. The new tool provides the following features that will enable you to control your personal budget.

Filters

Now that you have the option of seeing your transactions graphically doughnut or bar chart, you will be able to filter them in the following manner: Debit, VS (cash flow), Credit, Time, Categories or Tags.

What is the VS filter?

Here you will be able to compare your expenses vs your income for the past six months with the help of a bar chart. Remember that you may select additional months in the Timeline for any of the selected filters. You may also switch your view between a bar or a doughnut chart when you wish, except when you choose the VS filter.

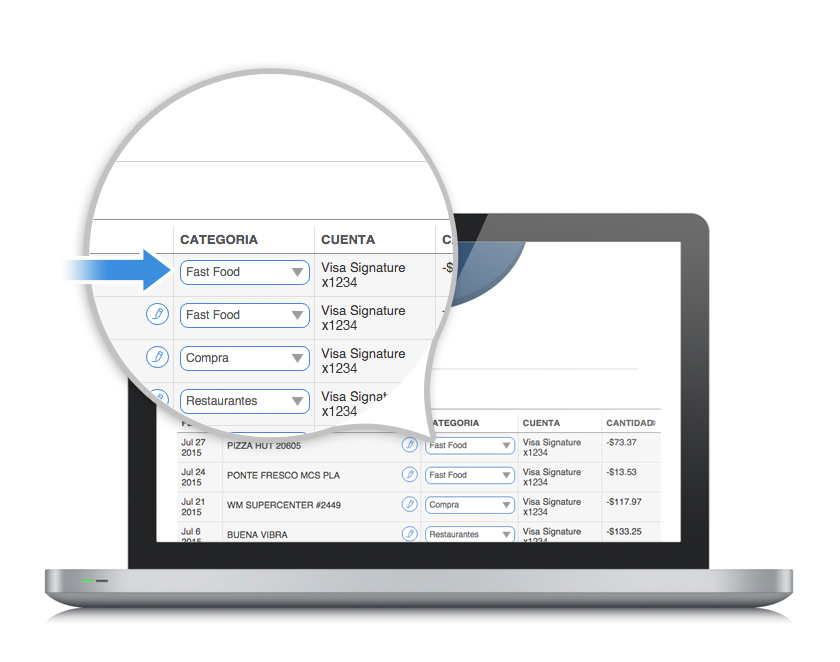

Categories

Select between the pre-established 19 categories and take into consideration how much you are spending in each of them; from food, kids, to health, travel, among others. You will also be able to add personalized sub-categories within the category and edit transactions in a given category for better analysis. For example, within the kids category you may add a sub-category for uniforms.

Tags

With the tag feature you will be able to group transactions in different categories that relate to each other.

Why are they useful?

Imagine that you managed to save $1,200 to remodel your kid's room. If you add a tag in each transaction related to your remodeling the tool will group all of them. This way you control your paint, furniture and tools expenses in an organized manner. It helps you be on top of your expenses and be fair to the budget established for the remodeling.

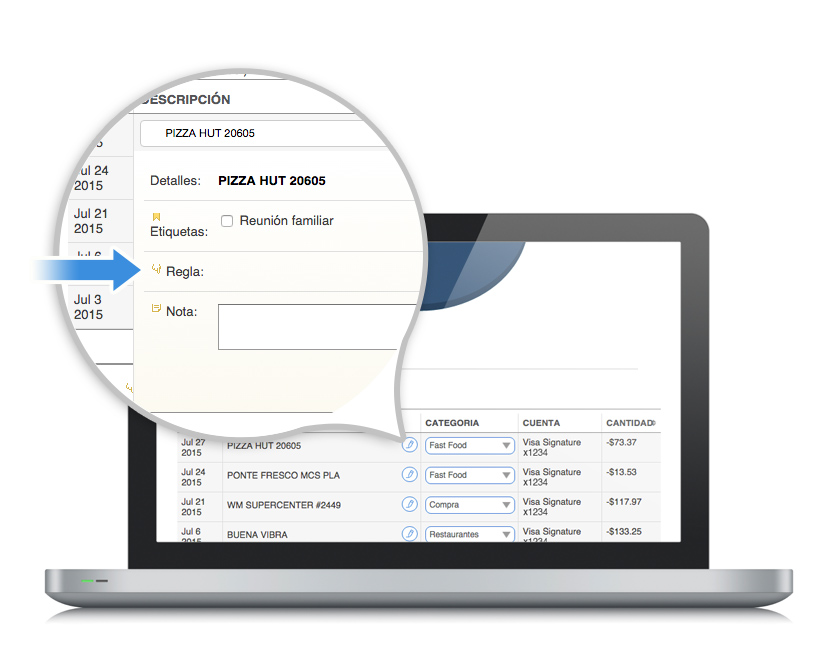

Rules

To change a transaction from the pre-established category to another of your preference you have to create a rule. After the rule is created the transaction will fall in the category of your preference. For example, you may create a rule that states that every time you go to your favorite food truck the transaction falls in the Fast Food category instead of in the Restaurant one.

Modify Transactions

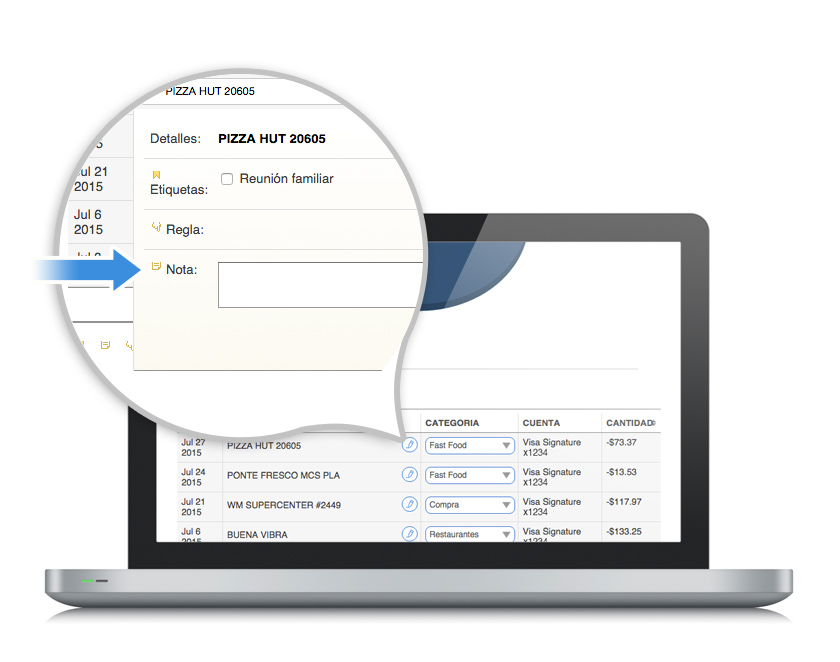

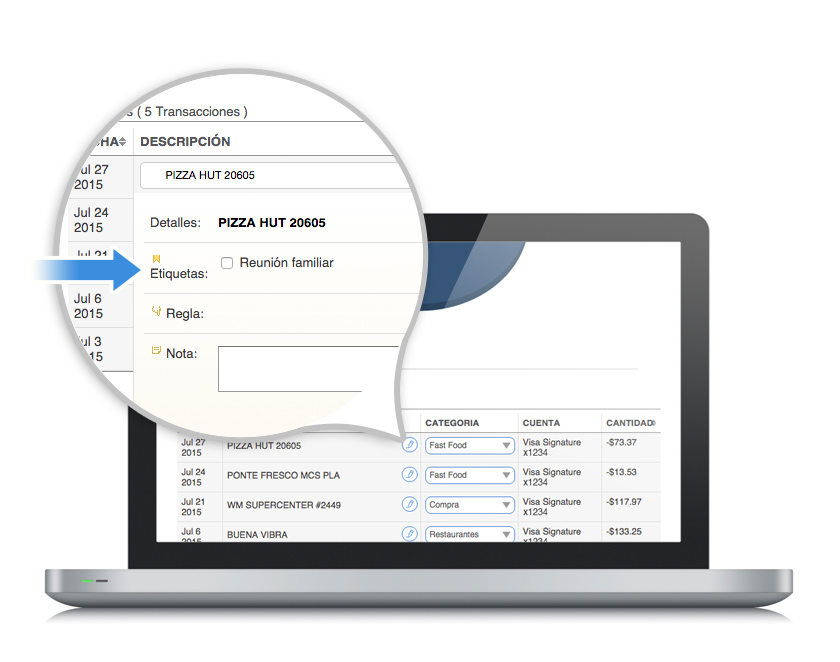

If you wish to edit the transaction's category or add information just go to the transactions list below the graphics or in the account section and look for what you wish to edit. When you select the transaction you may be able to do the following:

- Edit the description

- Edit or change categories and sub-categories

- Create or assign tags

- Add a note to the transaction

- Activate or create new rules

Puerto Rico

Puerto Rico