March 3, 2023 | Category: Financial Planning

For many, keeping their financial accounts up to date can be challenging. However, what some don't know is that digital platforms like eMoney, from eMoney Advisor, LLC, help organize their capital accounts and investments in a single place. This, in turn, reduces the complexity of this task and lets you take control of your finances.

Did you know that, as a Popular One client, you have access to this platform? The eMoney portal keeps you connected to your finances and monetary assets in a simple and integrated way; and supports you in managing your financial goals.

With eMoney, you can plan, monitor, and manage your finances to make informed decisions. The portal lets you visualize and manage all your capital, including your bank accounts, investments, credit cards, retirement, loans, insurance accounts, properties, and more. This platform can help you better understand your finances and meet your financial goals.

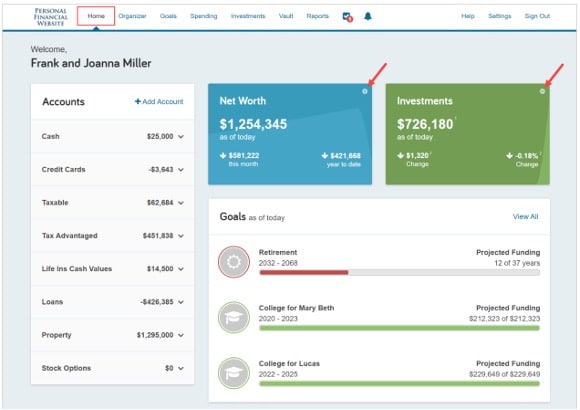

Your home page includes an overview of your financial information. The data is updated daily based on the established connections. The page is divided into sections, which can be accessed for more details.

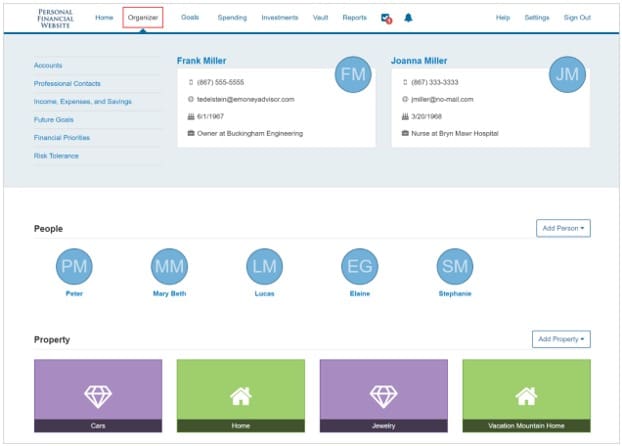

Organizer

The Organizer allows you to consolidate all your important financial information in one place. You can click on the sections to the left to add your accounts, financial data, people, and properties. Information within the Organizer is used to populate other sections of the portal.

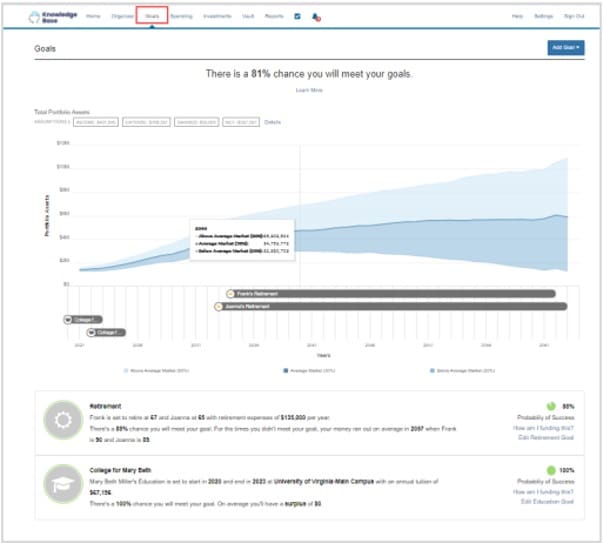

Goals

The Goals section lets you track your progress toward your established goals and see their impact on your financial situation. When you access a goal, the portal provides information on projected costs, funding, and recommended actions to improve your results.

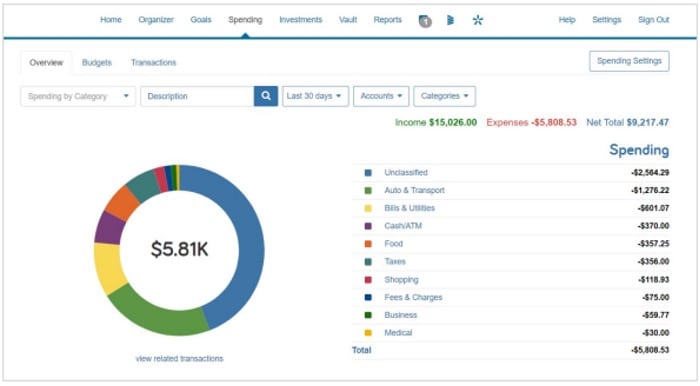

Spending

The Spending section gives you a clear view of your monthly expenses. This section contains tabs for Overview, Budgets, and Transactions. Use these three tabs combined to obtain an accurate picture of your expenses and current budget.

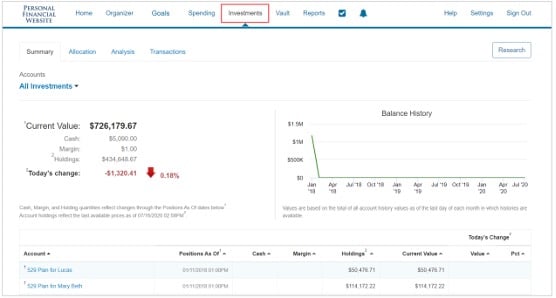

Investments

The Investments section contains the following tabs: Summary, Distribution, Analysis, and Transactions. These provide an overview of your investments. They also allow you to view the activity of each individual account and asset breakdowns.

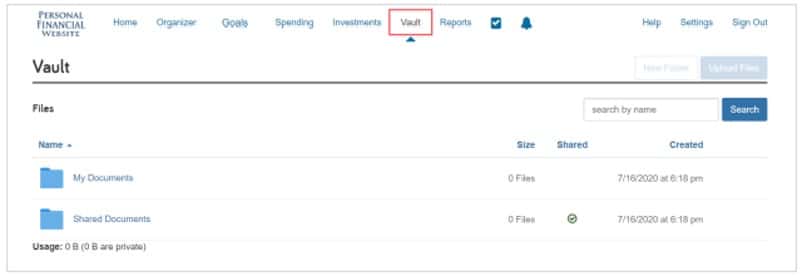

Vault

The Vault is a secure and searchable repository where you can save your financial documents and where your private banker can upload documents for your review. You can use the shared folder to provide information to your private banker and My Documents folder for your personal use.

Reports

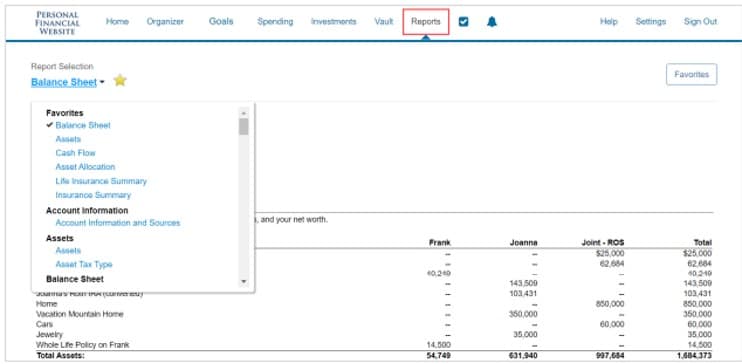

The Reports tab provides a series of reports on your current financial situation.

Some of these reports include:

- Balance Sheet: Details the distribution of your assets, debts, and net equity.

- Cash Flow: Shows the net movement of money between your revenues and expenses.

- Investment Breakdown: Provides the current diversification and average returns of your investment portfolio.

Our team of professionals at Popular One is ready to assist you with eMoney and help you manage your finances, investments, and personal and business risks. Contact your Private Banker today by calling us at 787-281-7272 or email us at popularone@popular.com