June 2, 2022 | Category: Financial Planning

Your long-term retirement strategies must account for inflation – or else.

You hear it all the time: you should make sure your retirement savings at least keep pace with inflation. But what is inflation and how does it really affect your retirement savings? Let’s explore.

Inflation is defined as an increase in the general level of prices for goods and services. Deflation is a decrease in the general level of prices for goods and services. If inflation is high, at say 10% – as it was in the 1970s – then a loaf of bread that costs $1 this year will cost $1.10 next year.

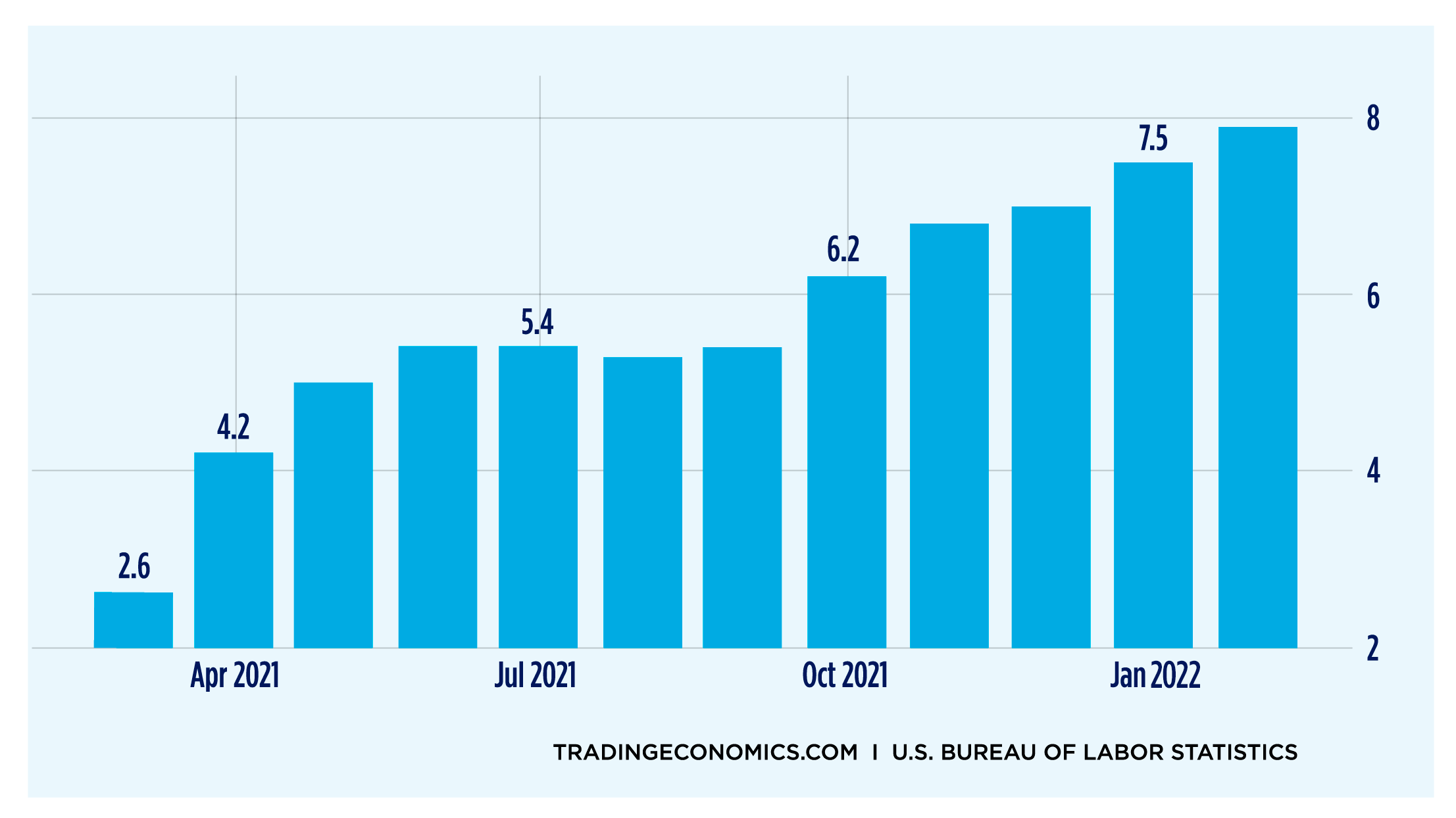

Inflation in the United States has averaged around 3.24% from 1914 until 2021, but it reached an all-time high of 23.70% in June 1920 and a record low of -15.80% in June 1921. Most will remember the high inflation rates of the 70s and early 80s when inflation hovered around 6% and occasionally reached double-digits. But in 2021, inflation went up every single month.

How Does Inflation Impact Your Retirement?

The answer is simple: inflation decreases the purchasing power of your money in the future. Consider this: at 3% inflation, $100 today will be worth $67.30 in 20 years – a loss of 1/3 its value.

From another perspective, that same $100 will only buy you $67.30 worth of goods and services in 20 years. And in 35 years? Well, your $100 will be reduced to just $34.44.

How is inflation calculated?

Fortunately for us, we don’t have to calculate inflation – it’s done for us. Every month, the Bureau of Labor Statistics calculates indexes that measure inflation:

- Consumer Price Index – A measure of price changes in consumer goods and services such as gasoline, food, clothing and automobiles. The CPI measures price change from the perspective of the purchaser.

- Producer Price Indexes – A family of indexes that measure the average change, over time, in selling prices by domestic producers of goods and services. PPIs measure price change from the perspective of the seller.

How the Federal Reserve attempts to control inflation

Until the early part of the 20th century, there was no central control or coordination of banking activity in the United States. The US was the only major industrial nation without a central bank until Congress established in 1913 the Federal Reserve System with the enactment of the Federal Reserve Act.

With the Federal Reserve Act, Congress set three very specific goals for the Fed: to promote maximum sustainable employment, stable prices, and moderate long-term interest rates.

To help the Fed stabilize prices, Congress gave the Fed a very powerful tool: the ability to set monetary policy. And one way the Fed sets monetary policy is by manipulating short-term interest rates in an effort to control inflation.

If the Fed believes that prevailing market conditions will increase inflation, it will attempt to slow the economy by raising short-term interest rates – reasoning that increases in the cost of borrowing money are likely to slow down both personal and business spending.

The flip side is true too: if the Fed believes that the economy has slowed too much, it will lower short-term interest rates to lower the cost of borrowing and stimulate personal and business spending.

As you might imagine, the Fed walks a very fine line.

If it does not slow the economy soon enough by raising rates, it runs the risk of inflation getting out of control. And if the Fed does not help the economy soon enough by lowering rates, it runs the risk of the economy going into recession.

Currently, the Fed believes that “inflation at the rate of 2 percent (as measured by the annual change in the price index for personal consumption expenditures, or PCE) is most consistent over the longer run with the Fed’s mandate for price stability and maximum employment.”

What investors need to remember

Therefore, it is imperative that your long-term retirement strategies account for inflation and that you prepare for a decrease in the purchasing power of your dollar over time. You should strongly consider assuming that inflation will be more than 3% – its historical average.

It’s true that inflation today hovers around 8% – four times the Federal Reserve’s target inflation rate – but a better assumption might be one based on the last 100-years of data (3.24%).

If you find that the inflation rate for the next 25 years turns out to be 2%, then the purchasing power of your retirement savings will be more.

Make sure you plan with your Private Banker

In Puerto Rico, inflation is measured based on the rise or fall in the price of certain goods, but it can usually be higher than in the United States.

Remember that at Popular One our licensed personnel can help you maximize your funds during retirement. Call us at 787-281-7272 to get started.

Copyright © 2022 FMeX. All rights reserved.

Distributed by Financial Media Exchange.

The information provided is for educational purposes and for your independent consideration. This information does not contain, constitute or provide individual tax, financial, investment or other advice. This material does not include or take into account all the factors that may be relevant to your financial needs; they are not intended to be regarded or construed as advice or a suggestion for you to take (or refrain from taking) a particular course of action. In providing this information, we assume that you are capable of evaluating the information and general descriptions contained herein and exercising your independent judgment. Banco Popular de Puerto Rico, its subsidiaries and/or affiliates are not engaged in rendering legal, accounting, or tax advice. Should legal, accounting, or tax advice be required, the services of a competent professional should be sought.

Investment products are not insured by the FDIC, are not deposits or obligations of and are not guaranteed by Banco Popular de Puerto Rico or its subsidiaries or affiliates and may lose value, including the loss of the principal invested.

Wealth Management services are available to clients who maintain deposits and/or investments of $500,000 or more at Popular.

Puerto Rico

Puerto Rico