February 27, 2022 | Category: Investments

The gradual removal of policy support and stimulus implemented to combat the economic downturn triggered by the COVID-19 pandemic poses a new challenge for policymakers and a source of risk for financial markets, according to Vanguard Economic and Market Outlook for 2022: Striking a Better Balance.

The global economic recovery is likely to continue, albeit at a slower rate. Health outcomes will remain important given the emergence of the Omicron variant, but the outlook for macroeconomic policy will be more crucial. Labor markets will continue to tighten, with several major economies, led by the U.S., quickly approaching full employment.

Our outlook focuses on these key themes:

Inflation will be lower but stickier. We anticipate that supply/demand frictions will persist well into 2022 and keep inflation elevated. But it is highly likely that increases in the prices of goods and services will slow during the year, even amid persistent wage gains.

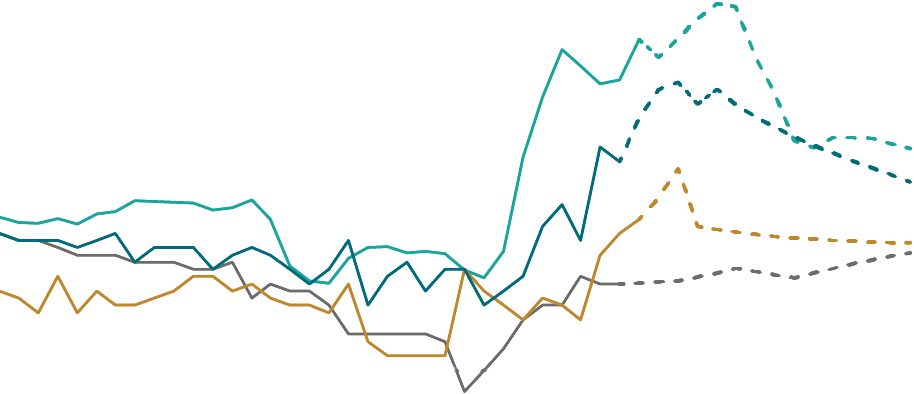

How long will inflation last?

Core CPI, year-on-year change

Notes: Data and Vanguard forecasts are for year-on-year percentage changes in the core Consumer Price Index, which excludes volatile food and energy prices. Actual inflation is through September 2021 for the U.S., U.K., and China and through October 2021 for the euro area. Vanguard forecasts are presented thereafter.

Sources: Vanguard calculations, using data from Bloomberg and Refinitiv.

The risk of a policy misstep has increased. Central bankers will have to strike a delicate balance between controlling inflation expectations and supporting full employment as they withdraw exceptionally accommodative policies. In the United States, the Federal Reserve may have to raise rates higher than some expect, perhaps to at least 2.5%.

Rising rates won’t upend bond markets. Rising inflation and policy normalization mean that the short-term interest rates targeted by the Fed, the European Central Bank, and other developed-market policymakers are likely to rise. But rising rates are unlikely to produce negative long-term total returns in bond markets. We expect annualized U.S. bond returns of 1.4%–2.4% over the next decade.

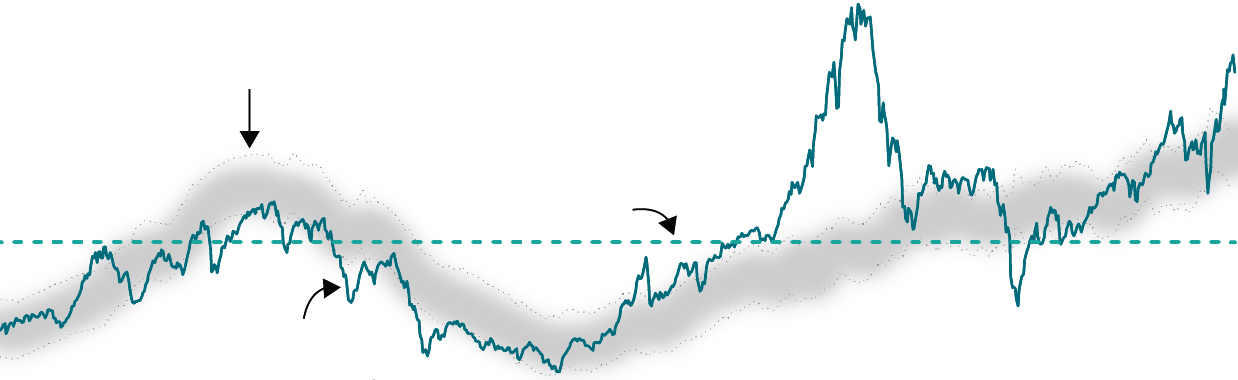

Equities face a challenging environment. Low bond yields, reduced policy support, and stretched valuations in some markets form a challenging backdrop for equities. We are projecting the lowest 10-year annualized returns for global equities since the dot-com bubble of the early 2000s. For example, we expect U.S. equity returns of 2.3%–4.3% per year.

U.S equities have not been this overvalued since the dot-com bubble

Cyclically adjusted price/earnings ratio

Notes: The U.S. fair-value CAPE is based on a statistical model that corrects CAPE measures for the level of inflation and interest rates. The statistical model specification is a three-variable vector error correction, including equity-earnings yields, 10-year trailing inflation, and 10-year U.S. Treasury yields estimated over the period January 1940 to September 2021. Details were published in the 2017 Vanguard research paper Global Macro Matters: As U.S. Stock Prices Rise, the Risk-Return Trade-Off Gets Tricky (Davis, 2017). A declining fair-value CAPE suggests that higher equity risk premium (ERP) compensation is required, while a rising fair-value CAPE suggests that the ERP is compressing.

Sources: Vanguard calculations, based on data from Robert Shiller’s website, at aida.wss.yale.edu/~shiller/data.htm, the U.S. Bureau of Labor Statistics, the Federal Reserve Board, Refinitiv, and Global Financial Data, as of September 30, 2021.

Source: Vanguard Capital

The information provided is for educational purposes and for your independent consideration. This information does not contain, constitute or provide individual tax, financial, investment or other advice. This material does not include or take into account all the factors that may be relevant to your financial needs; they are not intended to be regarded or construed as advice or a suggestion for you to take (or refrain from taking) a particular course of action. In providing this information, we assume that you are capable of evaluating the information and general descriptions contained herein and exercising your independent judgment. Banco Popular de Puerto Rico, its subsidiaries and/or affiliates are not engaged in rendering legal, accounting, or tax advice. Should legal, accounting, or tax advice be required, the services of a competent professional should be sought.

Brokerage services are offered through Popular Securities, LLC, registered broker/dealer, member FINRA & SIPC. Investment advisory services are provided through Popular Securities, LLC., a registered investment adviser. Popular Securities, LLC is a subsidiary of Popular, Inc. and is affiliated with Banco Popular de Puerto Rico. Popular Inc. and Banco Popular de Puerto Rico are not registered broker/dealers nor registered investment advisers. Popular One is a platform of integrated financial services centered on you through which Popular Securities services are offered. Investment products are not insured by the FDIC, are not deposits or obligations of and are not guaranteed by Banco Popular de Puerto Rico or its subsidiaries or affiliates, are subject to investment risk and may lose value, including possible loss of the principal invested.

Popular Securities is not affiliated with the links included in these communications and does not guarantee the accuracy or the integrity of their content. Nor the information and the opinions expressed constitute a solicitation from part of Popular Securities to retained, buy or sell any investments.

Wealth Management services are generally available to clients who maintain deposits and/or investments of $500,000 or more at Popular.

Puerto Rico

Puerto Rico